behavioral finance

It is a part of Psychology that is based in theories to explain stock market anomalies. It is important know that the information structure and the characteristics of market consumers influence so much in individuals' investment decisions and in the market results.

The behavioral finance pay attention in the factors that impulse investor behavior and use them for positive investment decisions.

The central subject in behavioral finance explaining why market participants make irrational systematic errors contrary to the rational market participants. These errors affect prices and returns, creating market inefficiencies.

It also investigates how other participants use this errors and market inefficiencies.

Technical analysts consider behavioral finance, to be behavioral economics' "academic cousin" and to be the theoretical basis for technical analysis.

In addition it will help explain why housing prices rarely and slowly decline to market equilibrium levels during periods of low demand.

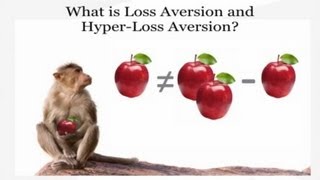

Other observations include the asymmetry between decisions to acquire, or keep the resources. The aversion appears in investor behavior as a renounce to sell shares or other equity, if result is in a nominal loss.