risk-return trade-off

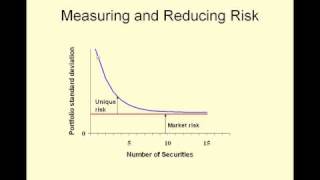

The market risk is a measure of the market uncertainty and it is characterized by its variance. Investors assume high risks because the market returns high profitability for assuming those risks.

The rate of return on an investment can be calculated as follows:

(Amount received- Amount invested)/ Amount invested

The investment risk is the posibility to receive a low or negative actual return. This way, the greater the chance of lower or negative return, the riskier the investment.

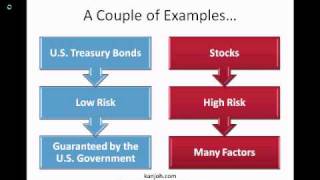

The concept of Risk-Return is related to the fact that the investor increases his risk, so his profitability will increase; on the contrary, if he wants his risk to be lower, the profitability will be lower too.

Therefore, the most profitable investments are those that provide bigger profitability, risking in the market a lot of money.

On the other hand, the investments with lower risk are those that generate less income but have insurance profits.

Normally, big companies choose riskier investments in order to maximize their profits and reduce the market risk with the diversification.