current ratio

Este contenido está disponible en los siguientes idiomas: Español | Inglés

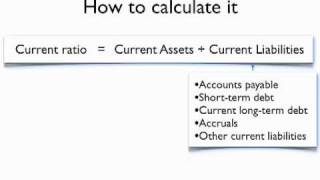

This is the relationship between current assets and current liabilities. (current assets / current liabilities)

A business´s current capital is expressed in the form of a ratio which measures its capacity to pay off the debts that are derived from the operating cycle. Sometimes this is identified as general liquidity, technical solvency, current solvency or the working capital ratio. That being stated, the analysis and interpretation of this ratio will depend on some diverse circumstances: turn-over and the periods of the phases of the operating cycle, the values of the previous ratios (cash assets ratio and acid-test ratio), etc. A business can have a current ratio with a low value. However, this doesn´t necessarily mean that it isn´t very solvent if its turn-over is high. On the other hand, a business could have a high current ratio but not be able to pay its immediate debts because of not having enough cash-on-hand (if its cash assets ratio with very short-term liabilities is less than 1).

Current Ratio (CR) = current assets / Current liabilities

From the analysis of this ratio, one can look for two outcomes, both of which can be broken down into two parts each:

- CR > 1- if the Working Capital Payback Period is greater than 0, the business is in a good situation, depending on the current capital minimum. - if the Working Capital Payback Period is less than 0, the business is in a bad situation since there would be excess liquidity.

- CR < 1 - if the Working Capital Payback Period is greater than 0, the business is in a bad situation because there would be a cash deficit.- if the Working Capital Payback Period is less than 0, the business is in a good situation, depending on the current capital minimum.