preferred stock

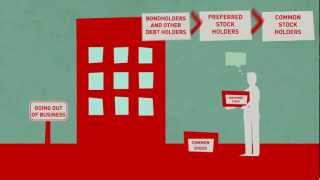

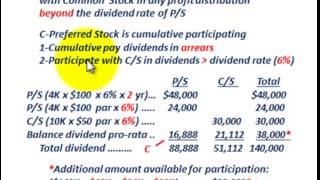

Also known as a preferred share or a preffered stock option. A type of security that gives its owner a higher ranking claim on a shared asset or the earning of company´s common stock. It usually pays a (fixed) dividend which is paid before paying common stock owners their share of dividends but they usually do not provide voting rights to their owners. preferred stocks have some characteristics like debt securities and some like equity securities.

It is the security issued by a company that does not give participation in its capital or right to vote. It has a perpetual character (it does not have a maturity date) although the issuer usually reserves the right to amortize them after five years; its yield is usually variable, it is not guaranteed; therefore, they are complex instruments and of high risk because they are not guaranteed by the deposit and investment Guarantee Fund. The remuneration is conditioned to the issuer making a profit; normally being fixed for the first year. From the second year on, the remuneration is normally matched to the euribor, or other benchmark rate, plus a differential.