liability

Total debts and charges of a person or entity, and also the cost or risk that counterbalances the profits of a business, all of which is considered to decrease equity. There are current liabilities and long-term liabilities.

Liabilities can be divided based on when the debts are payable; debts payable within a year are current liabilities (payables or current debt), while those debts payable over a year are long-term liabilities. Ideally, short-term assets should counterbalance short-term liabilities.

Current liabilities include:

- Bank indebtedness: shows the amount owed to the bank.

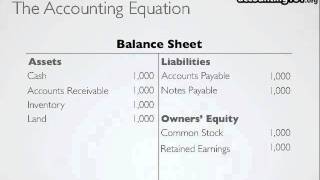

- Accounts payable: total amount owed to the company’s suppliers or service providers.

- Notes payable: amount that the company owed to a creditor, usually carrying an interest expense.

- Dividends payable: dividends that have to be paid to the owners or shareholders.

- Current portion of long-term debt: the portion maturing of long-term debt is classified as a current liability.

- Payroll, rent, tax and utilities: amount payable to employees, landlords, government, and others.

- Unearned revenue: it is an advance payment from the customers.

- And others long-term liabilities include:

- Long-term bonds .

- Mortgage loans .

- Notes payables: same as in current liabilities, only with a longer due date.

- Long-term leases.

- Long-term product warranties: long-term assurances on the sold products.