bond

Este contenido está disponible en los siguientes idiomas: Español | Inglés

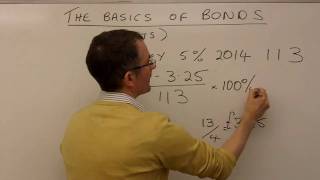

A fixed-income asset payable to bearer. It is a debt instrument issued by the monetary authority of a country or a large corporation with a maturity, usually between 2 and 5 years.

It is purchased for a price less than nominal value, which is the amount to be received in the time of maturity. Such securities can be traded on the exchange market. They can be both enterprise and institutions (public debt). Depending on the characteristics of the bond, they can be classified into:

- The par value bond: Issued at nominal value.

- The discount bond: Issued at a discount to their nominal value, with the discount being the charged interest.

- Premium bond: Issued at a premium over nominal value.

- Convertible bond: Can be redeemed for future new shares at a certain price.

- Zero coupon bond: it is one that does not pay interest until the amortization of the capital is completed. Its price is usually less than its nominal value.

- Government bond: is a public debt security issued by the State with maturity between 2 and 5 years.

- Market risk: is relative to the price of the bond varies depending on the change in market interest rates.

- Credit risk: is the possibility that the issuer is unable to pay the bond´s payment derivatives.