interest rate

It is the percentage charged to obtain money for a certain period of time or a percentage earned for investing in capital or saving. This is also called the price of money. The interest is what the financial institution collects from the lender (in the form of deposits, fixed rate securities, etc.). It is expressed in percentage of principal or capital. There are two general types: simple interest (interest on capital without taking into account the gains) and compound interest (interest on capital where the gains are accumulated to generate more and more).

The different types of interest rates may be classified in:

1. Duration

2. Term and liquidation

3. Uniformity or not

1.Duration

- Simple: in the short term, in which interest is not added to the capital, and therefore generates new interest, but they are collected.

- Compound: At the end of the year, interest is added to the initial capital, generating this way new interest.

- Nominal annual rate: percentage of money given when the payment of interest takes place. For example, if there is a 6% nominal annual rate and it is applied once a year, a 6% is paid from what was saved up until the moment. If it were applied once a month, instead of once a year, it would be 6%/12=0,5% for each month and would be applied to the total amount saved. But at the following month, the nominal annual rate is applied on the amount saved plus the interest earned. This way, at the end of the year it would be as if you had more than a 6% interest rate.

- Effective interest rate: interest rate that indicates the financial security´s cost or effective yield. The Annual Percentage Rate is estimated with a mathematical formula that keeps in mind the nominal annual rate of the operation, the frequency of payments (monthly, quarterly, etc.), the commissions and some operation expenses.

3.Uniformity or not

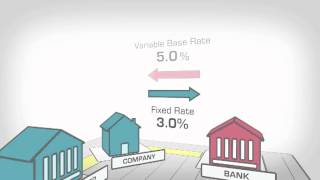

- Fixed: An operation will have a fixed interest rate, when the same amount is applied during its entire duration. It is known when the contract is agreed and it will not change.

- Variable: An operation will have a variable interest rate when it is agreed to be modified in predefined periods (normally each semester of the year or each year). For this kind of procedure, the financial institution fixes a benchmark interest rate, such as euribor, whose evolution determines the increase or decrease of the interest payment.

- Benchmark interest rate: Rates of interest averaged together which are taken as a reference for the calculation of the rate interest that must be paid in a financial operation, normally adding up a differential percentage (for example, for mortgage loans it is normal to use euribor plus a variable rate which depends on each entity´s offer).

- Mortgage euribor: Official reference rate recommended by European banks for mortgage loans and consumption loans.

- Euribor: (European Interbank Offered Rate) Interbank rate interest in the euro zone. Reference rate published daily, which indicates the average interest rate in which the financial institutions lend each other money in the euro Interbank market.

- EONIA: (euro Overnight Index Average) euribor´s effective benchmark interest rate during the night after markets close. It is a weighted average rate of all the loan operations from one day to another without guarantee in the interbank market.

- libor: (London Interbank Offered Rate): It is a benchmark interest rate that reflects the rhythm up to which banks lend each other money every day. There are other references used, such as the LIBID (London Interbank bid Rate), LIMID which is a rate of interest between libor and LIBID. Each central bank has also authority to publish local reference indexes such as MIBOR (Madrid Interbank Offered Rate) or the French TEC-10. interest rates are used by the economic authorities as an instrument of economic policy.

The general theory on the use of interest rates in economic/monetary policy says that when economic authorities want to stimulate the economic growth they will decrease interest rate, which will raise consumption and investment, and in times when they want to control inflation or the growth of an economy; interest rates will be increased.